Thesis: Gold (XAU) is set for a massive correction in the coming weeks/months, and there’s nothing the Government or Central Banks can do about it.

For all its glitter and shine, Gold strictly as an asset that doesn’t pay interest or dividend (sans exposure via. Gold Loans, ETFs, MFs, etc.), is worthless and just like BTCUSD – most of its value is derived from perceived worth investors are willing to pay for it. Sure, Gold can have uses in electronics/chips, etc. but there are far better and cheaper alternatives than Gold to satisfy those requirements.

The reason I bring this up is because Gold has seen an exponential run-up in its price since 2022-23 Fed Rate Hikes, and has outperformed all major asset classes, including Crypto. The global geopolitical and economic uncertainty induced by inflation hedging, tariff-wars, visa restrictions, AI-doomsday scenarios, weak dollar, and Central Banks/Sovereign Wealth Fund purchases, has catapulted Gold to never-before-seen levels; and the supporters might be quick to point out that Gold’s value is justified at $3750+ (09/25/2025), we must look at this recent rally in its proper context.

The Rise of The Gold Mafia

Credit: all charts in this post, unless otherwise mentioned, are courtesy of TradingView.com charting tool.

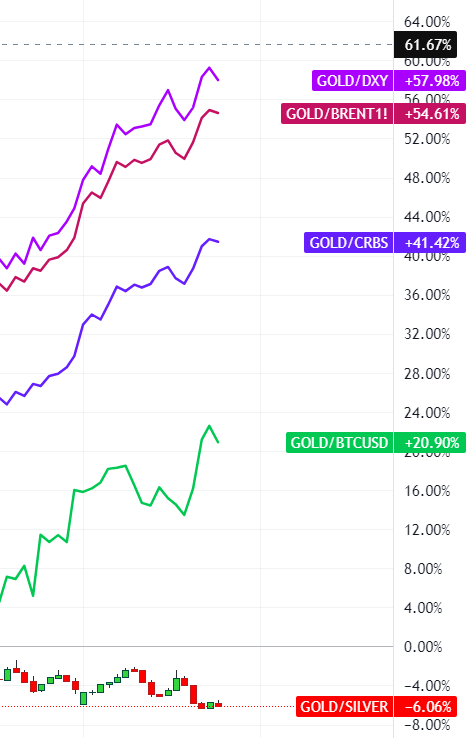

We we compare the relative price of Gold against other asset classes and commodity indices, we see that Gold has blown every single asset-class out of the water, DXY and BRENT CRUDE OIL being the most abused by the wrath of the Gold mafia.

With that said, one observation does stand-out: the GOLD/SILVER relative pricing.

As can be seen from the chart above, SILVER (XAG) has refused to bow-down to the supremacy of the Gold bull-run, and has held its own – in fact, has outperformed Gold in the same time-period. This begs the important question: WHY?

Historically, Gold (XAU) has been seen as a risk-off trade by investors – which means that when Investors are worried or concerned about the future or volatility in the markets or inflation, they start buying-up Gold, in essence parking their money in Gold, until the market conditions are safe enough to start unwinding and investing in other assets classes like Stocks, Corporate Bonds, Commodities, etc.

Silver (XAG) on the other hand has been a risk-on trade by investors – which means that investors are fairly confident about the future and stability of the markets, and corporate earnings, and inflation, they choose to stock-up Silver, because other then jewelry, Silver has major industrial use cases, namely:

Electronics

- Printed Circuit Boards (PCBs)

- RFID Chips and Conductive Inks

- Consumer Electronics – smartphones, computers, appliances, and high-performance GPUs

Solar Energy

- Photovoltaic Cells

Automotive Industry

- Membrane Switches and Sensors

- Electric Vehicles (EVs)

Chemical and Industrial Catalysts

- Industrial-grade Catalyst in Chemical Reactions

and many more such use cases.

Point being, when investors worry about the economy, they tend not to load-up on Silver because slower economy means less Industrial demand for silver.

The Rise of Silver

This time around though, despite the high degree of uncertainty, Silver has gone vertical and outperformed even Gold, which is probably a play on the Gold/Silver ratio initially being too expensive, and then Silver playing catch-up, due to its relative under-pricing with respect to Gold. The Quants and seasoned Precious Metal (PM) traders, love this – especially since the trade is a simple mean-reverting trade in the short-term.

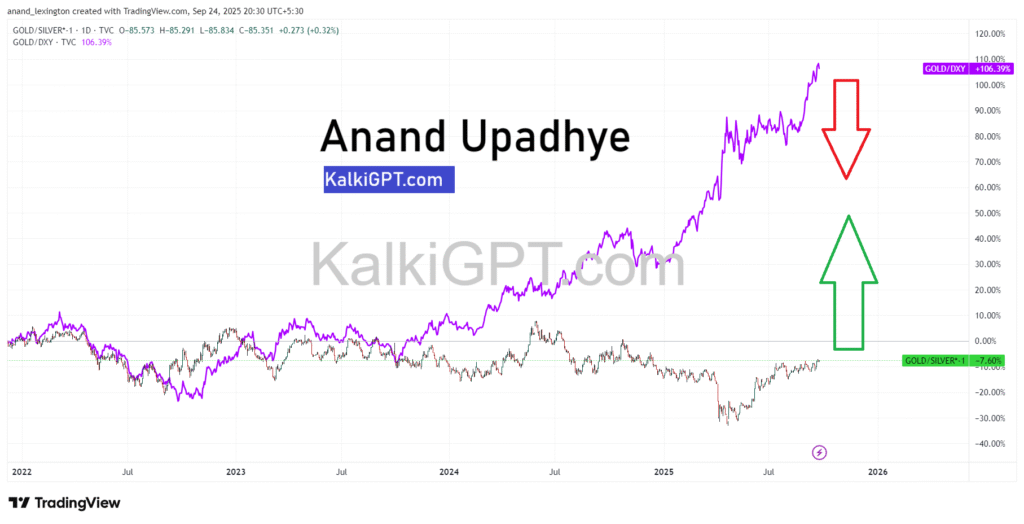

The bigger challenge in the long-term is the following chart:

When we invert the Gold/Silver ratio, and compare it’s relative performance against the Gold/DXY ratio, we notice something very stark and interesting – the ratios decoupled (diverged) sometime around August-September of 2023, and have not recoupled since – in fact, Gold has gone exponential in the same time, with an almost 114% gap between the performance of these 2 ratios.

This only leave us with one possibility – for these ratios to converge/mean-revert/recouple again to a state of equilibrium. This isn’t my opinion – this is pure mathematics and supply-demand economics. The is a 10-sigma divergence that we’re seeing, which like quantum-states, is unstable and doesn’t last for too long.

Let’s just keep an eye out to see how this trade unfolds!

For more insights, and in-depth analysis, checkout the 30-day Free Trial of our Kalki AI Finance Copilot.

Leave a Reply